When Curefoods — then known as Eat.fit — hived off from Cult.fit in 2020, it was something of a shot in the dark. The Ankit Nagori-led startup was not a major player among cloud kitchens at the time, and it was seen as a way for both Cult.fit and Eat.fit to sharpen their focus on their respective sectors.

Nagori’s Curefoods is likely to become the first cloud kitchen startup to list publicly after filing its DRHPat the end of June. Its closest rival and bigger player, Rebel Foods is also aiming at a public listing sometime next year, but Curefood seems like it might pip Rebel Foods to the post.

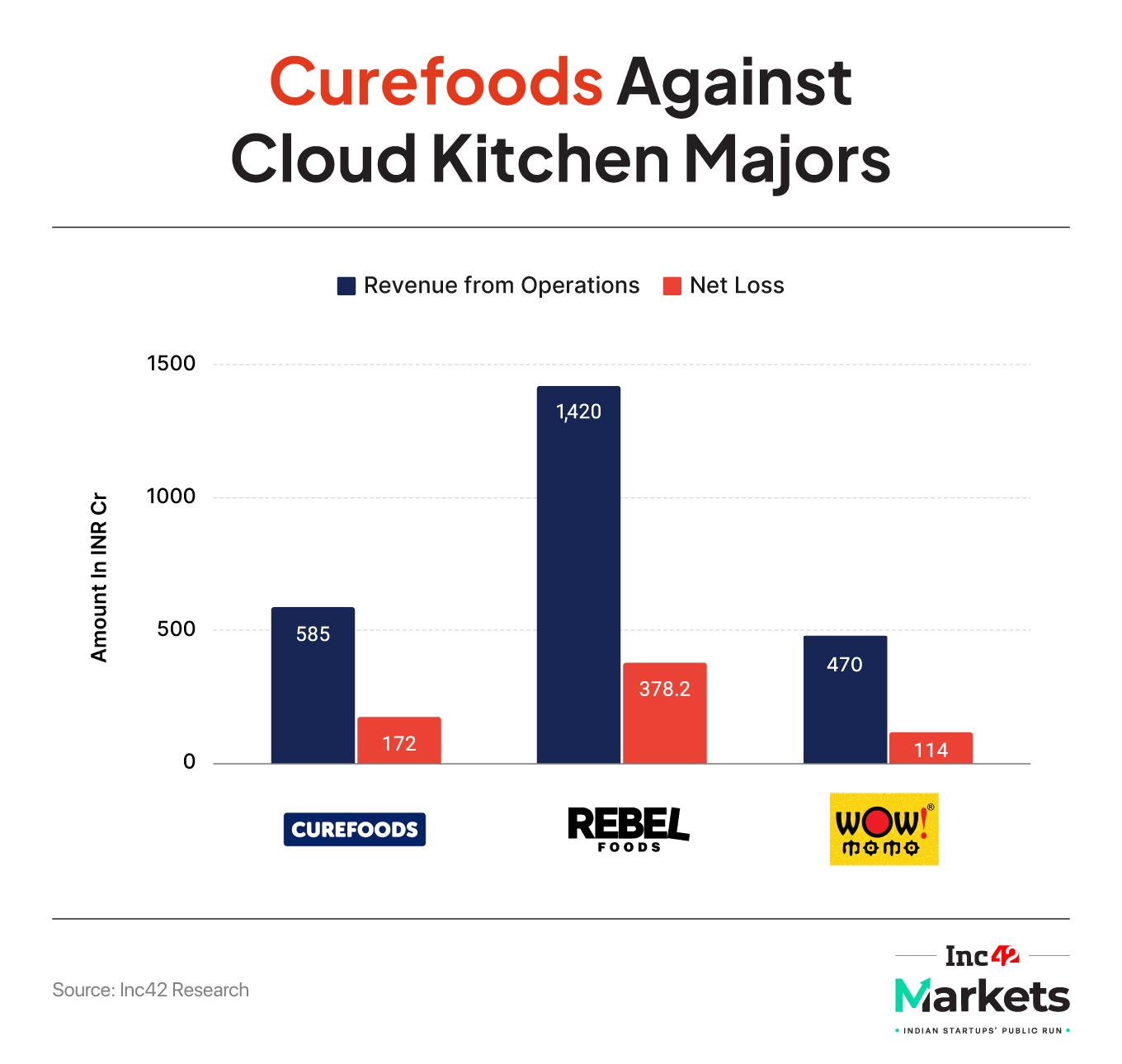

The Binny Bansal-backed startup’s IPO will be closely watched as it is the first public markets test for the cloud kitchen segment in India. It will also serve as a benchmark for the likes of Rebel, WOW! Foods and others that will follow the IPO path.

The startup is aiming to raise 800 Cr via a fresh issue while 4.85 Cr equity shares held by existing shareholders will be up for sale in the public offering.

It’s not uncommon for loss-making companies to go public, but Curefoods is one of the youngest companies to hit the public markets when it does. This has also attracted some attention from the investor ecosystem, amid concerns of limited operational history.

For context, Curefoods marginally brought down its losses to INR 170 Cr in FY25 on revenue of ONR 785 Cr, while Rebel Foods reduced its losses to INR 378 Cr in FY24 from INR 657 in FY23.

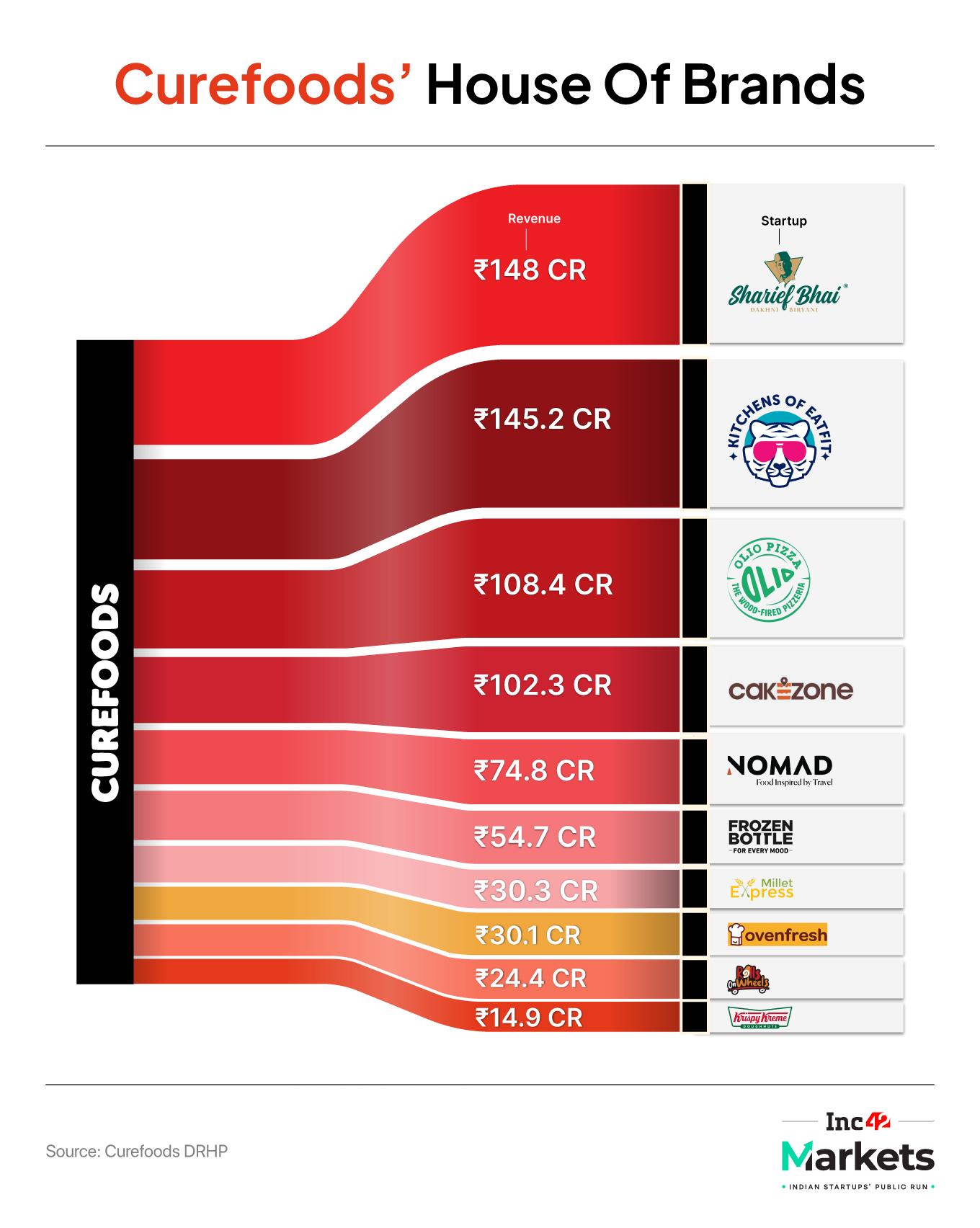

The House Of Brands StrategyIn all, Curefoods operates a host of brands across cuisines and formats through 502 cloud kitchens, kiosks, and restaurants across over 70 cities and towns in India. A bulk of these have come through acquisitions that have been a key feature of Curefoods’ relatively short journey thus far.

The company began with just one brand in its kitty — healthy meals brand Eat.fit — but it was followed by a string of acquisitions in 2022 (Canteen Central, Great Indian Khichdi, HomePlate, CakeZone, Instawitch). The momentum continued in 2023 and 2024 with acquisition of brands like The Gravy Company, Olio’s Pizza, Rolls On Wheels , Sharief Bhai among others.

The landmark acquisition however came in 2025 when Curefoods acquired the pan-India rights for popular international fast food brand Krispy Kreme.

A good part of the IPO proceeds will go towards adding 66 new cloud kitchens for existing food brands with Olio’s Pizza getting the most attention.

Notably, with the Krispy Kreme franchise rights, Curefoods is now amping up its offline play by setting up new kiosks and Krispy Kreme restaurants. It plans to invest INR 152 Cr into this brand, signalling its big role in Curefoods’ future plans.

Curefoods’ Revenue Concentration RisksBut there is one potential hiccup. Despite having so many brands under its portfolio, nearly 40% of Curefoods’ revenues comes from two brands – Sharief Bhai and Eat.Fit.

Pizza brand Olio and dessert brand Cake Zone contributed 14.5% and 13.7% respectively, which means that nearly 70% of the revenue comes from four brands. Given this context, the Krispy Kreme bet is a big one for Curefoods.

It’s indeed similar to what Rebel Foods did with Wendy’s, though Wendy’s has had its fair share of troubles when it comes to wide brand recognition. Krispy Kreme might have a better time given its focus on donuts as a category, but it will have to compete with incumbents like Dunkin’ Donuts and Mad Over Donuts.

As of FY25, Krispy Kreme contributed 2% of the company’s overall revenues, but these are early days.

Is Aggregator Dependency A Problem?A tougher challenge for Curefoods is its huge reliance on aggregator platforms.

According to the DRHP, nearly 85.6% of sales generated by its cloud kitchens are via Swiggy and Zomato platforms whereas only 14.3% are via non-delivery channels. We presume the latter is largely from B2B and catering opportunities for the brands in its umbrella as well as some sales from physical locations.

However, delivery platforms are key for Curefoods. If there is any disruption to the existing models of Swiggy and Zomato, there could be trouble for Curefoods and other dependent houses of brands.

This reliance on food aggregators manifests itself in terms of costs such as higher commissions, ad costs, data opacity, regulatory challenges in the delivery operations and more. These can have a trickle down impact on Curefoods brands.

Zomato and Swiggy’s algorithms and promotional strategies can impact sales and brand visibility as well, Curefoods states in its DRHP. Curefoods currently pays commissions to the tune of 18%-22% to aggregators which is subject to revision under various circumstances in the future.

Besides, aggregators and quick commerce platforms are also running third party or in house cloud kitchens which proves to be a competition to startups like Curefoods and impacts its brands visibility on these platforms.

For instance, Eternal owns Zomato as well as Blinkit’s Bistro while Swiggy has food delivery for restaurants and also operates its own kitchens through Snacc. These are relatively recent developments, so one cannot call it a huge challenge for Curefoods’ own business. However, this is likely to have a role to play in the future.

Despite challenges in driving growth for all its brands, Curefoods says it will continue to invest in the expansion of its existing brands, and acquire new brands. The startup is also focussed on quick commerce channels for revenue diversification, especially given the quick food delivery buzz.

As Swiggy, Zomato and Zepto have branched out to 10 minutes instant food delivery model by launching their snacks/ instant food focussed apps, Curefoods said that it is streamlining its cloud kitchen operations to reduce preparation time for various menus and sell via these quick commerce channels.

“By increasing the density of our kitchens in top cities and clusters, we aim to reduce drive times and ensure faster deliveries. Additionally, we are in the process of launching packaged foods and health snacks for quick commerce channels,” the company said.

These could help drive revenue growth without putting too much pressure on the company’s brand portfolio.

Can Cloud Kitchens Crack Profits?“The food business is a high margin industry where the successful brands go on to create value propositions and a sticky customer base which is particularly true for QSR chains and dine-in restaurants. For cloud kitchens, the brand recall is not as high as offline restaurants and this can be a challenge,” Akash Aggrawala, cofounder of D2C food startup Zoff, told Inc42.

Aggrawala believes that creating value in terms of distinct taste, quality controls will take time, but it will be a long-term moat for cloud kitchens. “There is a challenge with the cloud kitchen brands in terms of user stickiness. Restaurants end up building stronger brands. Often because of the high infrastructure and manpower costs. The brand matters a lot in the retail food business,” he added.

Curefoods’ revenue base pales against competitors in the QSR space, even though these rivals have been around for decades longer than Curefoods. Plus, Curefoods has seen a significant revenue growth (54% YoY) in FY24 compared to its competitors which grew in the range of 10%-20% YoY in FY24.

But unlike cloud kitchens, legacy restaurant giants are raking in profits. Jubilant Foodworks which owns Domino’s Pizza chain posted a net profit of INR 400 Cr in FY24, while Sapphire Foods which owns QSR chains like Taco Bell, Pizza Hut, KFC posted INR 51 Cr profit in FY24.

It must be noted that these companies typically focus on one or two brands and then look to drive operating leverage to maximise profits. Curefoods — even Rebel Foods — has taken a different approach, looking to build a portfolio.

The question is whether some of these brands will have to cut out of the portfolio in the near future, especially if Curefoods wants to walk the path of profitability.

Markets Watch: Deals, Share Prices, New IPOs & More- ArisInfra Bounces Back: After being on a downward trend since its listing, ArisInfra rose 7.8% to close Friday’s session at INR 172.65, with the market likely buoyed by the company’s INR 100 Cr order book

- Meesho Files Papers: Ecommerce giant Meesho has filed its DRHP with markets regulator SEBI via the confidential pre-filing route, joining the long queue of Indian new-age tech companies looking to go public

- Shadowfax Files Confidential DRHP: Three months after turning into a public entity, the logistics major has filed its DRHP with SEBI via the confidential route for an INR 2,500 Cr IPO

- Pitti Pledges His Stake:Six months after he pared his stake in Easemytrip, its chairman Nishant Pitti has pledged 9 Cr shares worth INR 94.5 Cr to Motilal Oswal Financial Services to raise fund for personal use

- Nopaperforms IPO:Amid the new-age tech IPO fervour, Info Edge-backed SaaS startup Nopaperforms, which operates the product Meritto, has converted into a public entity

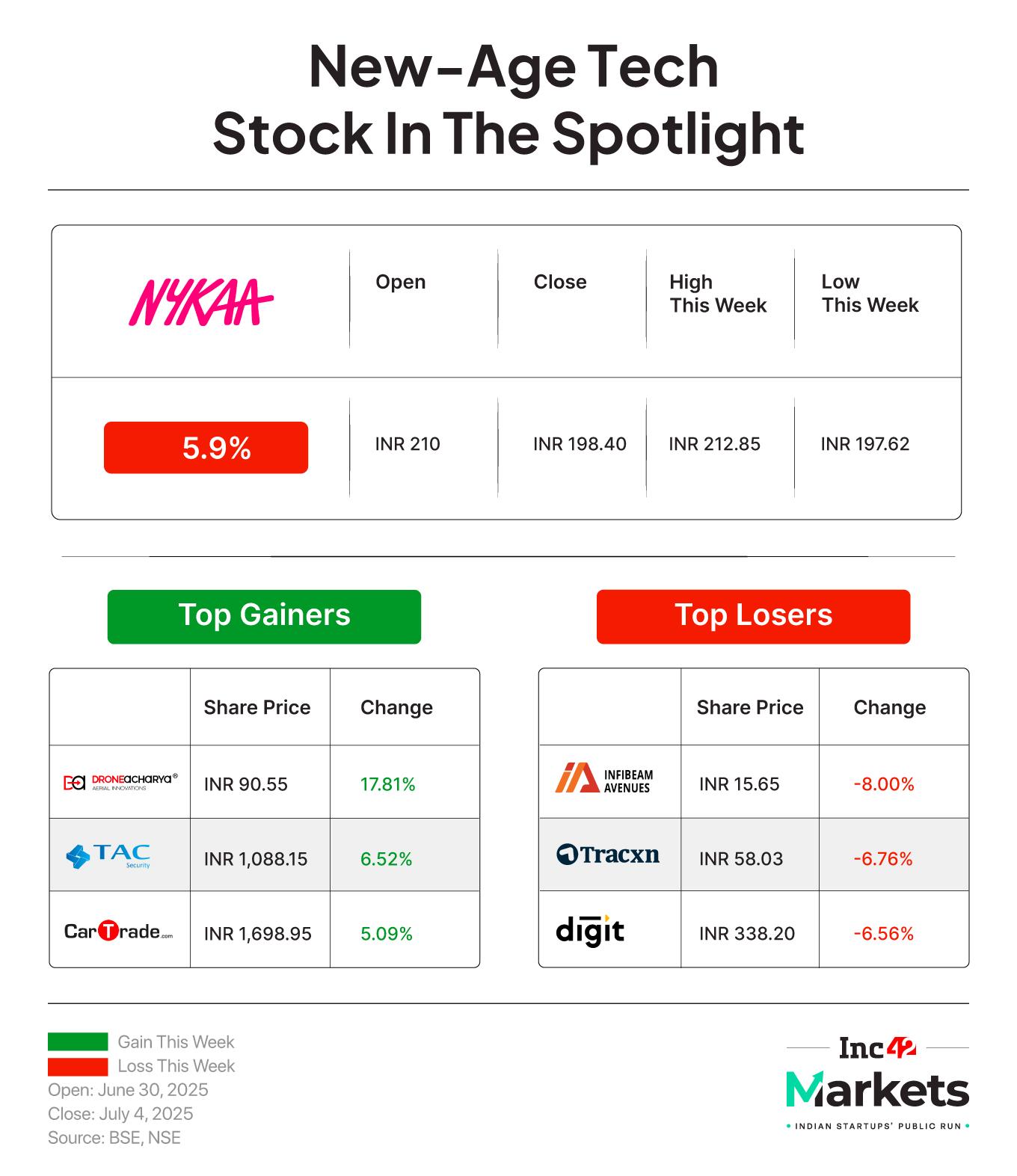

- Nykaa Falls:Shares of Nykaa this week amid reports of a large block deal, which was later confirmed, as Nykaa shares worth over INR 1,210 Cr changed hands

The post Curefoods’ IPO Recipe & The Cloud Kitchen Conundrum appeared first on Inc42 Media.

You may also like

'Aunt Fatima': Saudi horror game brings Gulf folklore to global fear fans

The world's 'safest country' in 2025 - not Japan nor Switzerland

The new 'big issue' faced by the UK 20 years after deadly 7/7 terror attacks

Wimbledon fine 12 players as Brit gets heaviest punishment for abusing staff

Even two decades on, I still wake up at 2am screaming, says 7/7's most injured survivor